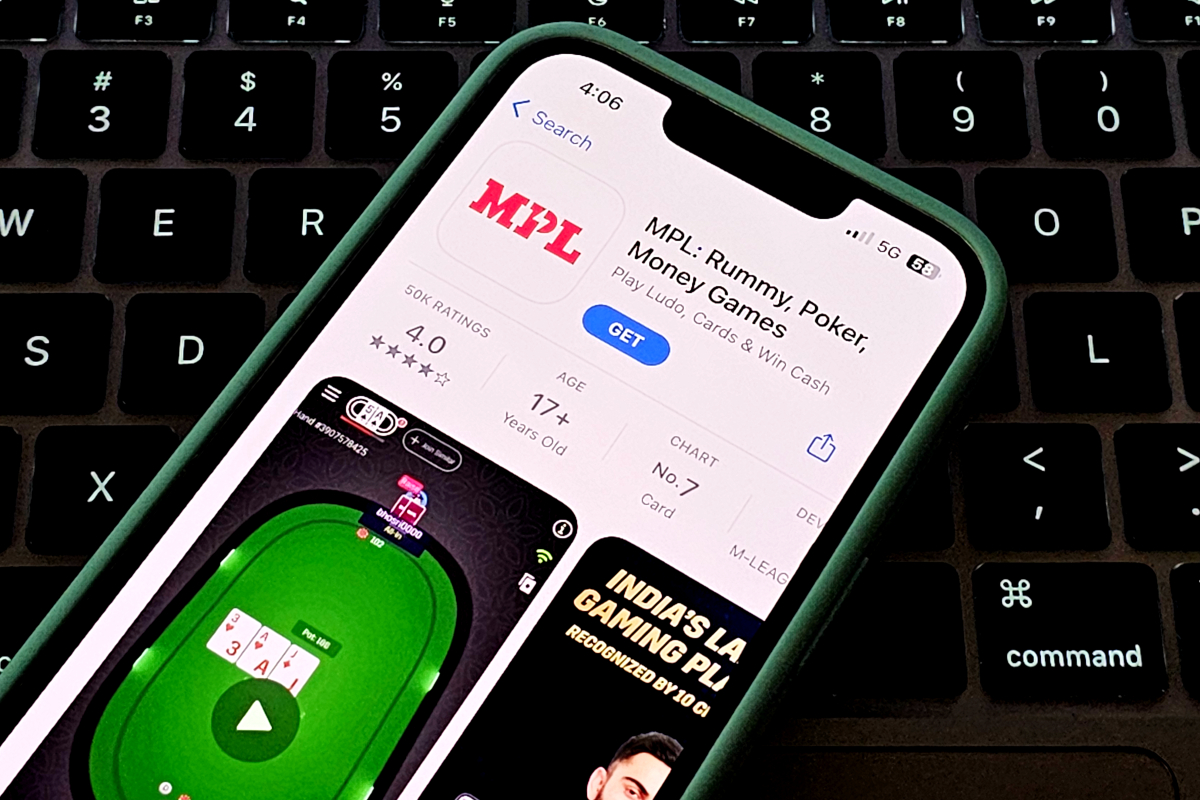

Peak XV-backed gaming startup MPL cuts workforce by 50% amid taxation changes

India’s popular online gaming and fantasy sports startup Mobile Premier League is reducing its staff by approximately 50%, two people familiar with the matter said, weeks after New Delhi implemented a 28% tax on online real-money games.

The Bengaluru-based startup initially announced its plans to cut jobs to employees last week and sent a formal communication on Tuesday, TechCrunch has learned. About 350 people will be let go.

MPL declined to comment. The news about the layoff has not been previously reported.

“As a digital company, our variable costs predominantly involve people, server and office infrastructure. Therefore, we must take steps to bring these expenses down in order to survive and to ensure that the business remains viable,” Sai Srinivas, founder and chief executive of MPL, wrote to employees on Tuesday.

The move comes in the wake of New Delhi enforcing a new taxation rule to the online gaming industry. India’s Goods and Services Tax Council, which comprises top federal and state finance ministers, announced plans to levy a 28% indirect tax on online gaming, casinos and horse racing.

The new taxation rule increases tax burden on MPL by as much as 350-400%, Srinivas wrote in the email Tuesday.

All India Gaming Federation, which represents players including Mobile Premier League, Gameskraft, Paytm First Games, Zupee, Nazara and Rush, labeled the new taxation rule “unconstitutional, irrational, and egregious.” Scores of top investors including Tiger Global, DST Global, Peak XV, Steadview Capital and Kotak Private Equity subsequently wrote a letter to Prime Minister Narendra Modi, urging him to reconsider the “onerous tax regime.”

The investors’ group said the decision would lead to a write-off of $2.5 billion and a loss of 1 million direct and indirect jobs. However, the Indian government did not roll back its decision.

To be sure, GST Council did introduce a measure to partially alleviate the industry’s concerns last week by implementing taxation on the total deposits made for playing online games rather than taxing every individual bet. Additionally, the council has planned to reevaluate this decision within the next six months following the implementation of the tax, set to take effect on October 1.

The five-year-old startup, which counts Times Internet, MSA Novo, Crown Capital, Composite Capital and Moore Strategic Ventures among its investors, has raised $396 million to date, according to market intelligence platform Tracxn.

“We have spent a lot of time evaluating and re-evaluating this decision; asking ourselves if we should wait or note. Eventually, we came to this conclusion because we believe that in uncertain times — the sooner we are able to deliver certainty to everyone, the better,” Srinivas said.