The valued startup types in today’s early-stage venture market

If you want to score the largest possible early-stage valuation, what should your startup focus on? New data makes it clear that the seed and Series A markets are hardly equal when it comes to what venture capitalists are willing to pay for one category of startup over another.

Don’t worry, the answer here is not just “build an AI startup,” even if that does appear to be pretty solid advice for avoiding a down round.

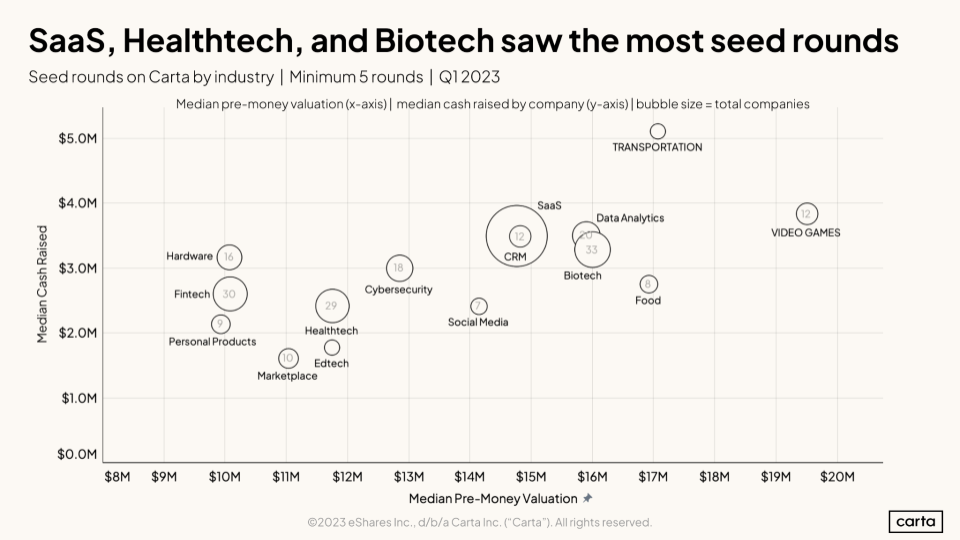

Data shared by Carta when we interviewed the company’s CEO on the Equity podcast earlier this week provides a simple and clear stratification of early-stage valuations and fundraising sizing. Let’s start with seed data:

Image Credits: Carta

More Stories

What is Meant by Blue Eyes Technology

The blue eyes technology works on Artificial Intelligence. It aims to give human abilities to a computer. A research team...

Bluesky adds self-labeling for posts and a dedicated media tab for profiles

X- (previously Twitter) and Threads-rival Bluesky has started allowing users to self-tag their posts so they can be automatically filtered....

Tesla supplier CATL unveils battery that can add up to 400km of range in 10 minutes

CATL, the Chinese battery giant and a major supplier to Tesla, has unveiled its latest product that aims to solve...

Tesla supplier CATL unveils battery that can charge 400km in 10 minutes

CATL, the Chinese battery giant and a major supplier to Tesla, has unveiled its latest product that aims to solve...

Paid users of X, formerly Twitter, gets a new tab to highlight their posts

X, formerly Twitter, has started rolling out a new feature for paid users to show off some of their posts...

X (formerly Twitter) makes X Pro (formerly TweetDeck) a subscriber-only product

Elon Musk-owned social network X, formerly Twitter, has made X Pro — which was previously known as TweetDeck — a...