What are public market investors looking for in IPOs?

What do public market investors want to see when investing in IPOs?

We put together a group of 50 of the highest-profile software IPOs (excluding outliers like Zoom during COVID) dating back to 2012. We also studied — but did not include — direct-to-consumer, internet, and fast-casual. We are happy to provide that data upon request.

The group presented here is a very strong representation of the last decade of tech IPOs. We looked for themes, trends and averages that would tell us what worked and sketch a profile of the software companies that have made it in the past.

To do so, we examined execution, performance, size, scale, margins, Rule of 40 and deal size (notional and %), which uncovered a lot of interesting conclusive data.

If a company is willing to accept the valuation the public markets ascribe, the timing is ripe. Jeremy Abelson

Key takeaway: Execution vs. estimates

The most significant finding was the impact of a company’s execution versus their estimate, also known as their “beat and raise cadence.”

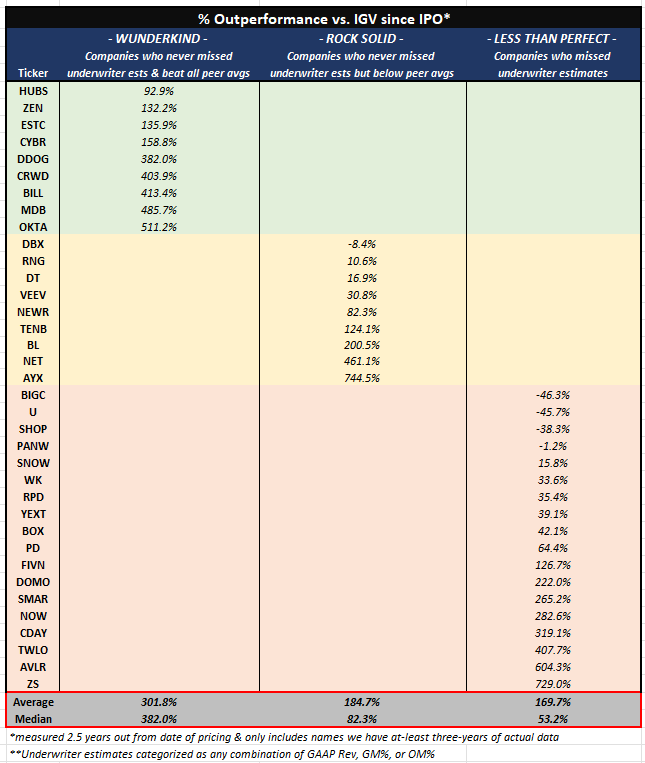

Our data show a staggering correlation between stock outperformance and the magnitude of a “performance beat” versus a company’s guidance at time of its IPO. To display this, we broke the group of companies down into three distinct performance groups:

- Group 1: Wunderkind

- Never missed estimates (GAAP revenue, GM%, OM%) and beat peer averages of each metric each quarter.

- Group 2: Rock solid

- Simply never missed a quarter vs. estimates (GAAP rev, GM%, OM%)

- Group 3: Less than perfect

- Missed on a minimum of one metric, one quarter

As you see in the chart below, the impact is significant. Group 1 outperformed Group 3 by a factor of ~7x (a median of 382% vs. 53%) over the space of two and a half years. (Please see red box for median and average.)

Note: This chart contains only 36 names, as we removed any without three years of data (e.g., 2021 IPOs), as well as any direct listings.

% of outperformance vs. IGV since IPO. Image Credits: Irving Investors

The data should be relevant to management teams that are currently thinking about setting underwriter estimates, which trickles down to IPO pricing and projected fair value of a company/stock.

The raw data

This chart includes the 50 relevant software IPOs we studied and how each company performed for three years versus projections given at time of their IPO across four very important metrics (our favorite being Rule of 40).

The important place to focus is on the quantum. The average beat on the top line is 35% in year three!

To be blunt, it is not uncommon for us to see private companies habitually “miss” versus projections. Companies learn quickly that the private markets forgive misses while public investors heavily punish misses, especially in first quarters post-issuance (and rewards beats).

For reference: FY+0 correlates to the year before a company’s IPO, which is the last year of all actual quarterly results; FY+1 is the IPO year and also the first year with any underwriter estimates; and FY+2 is the year following the IPO and the first full year of quarterly estimates.