Apple holds firm as leader in premium smartphones with 71% global market share in 2023

According to the latest report from Counterpoint Research, tech behemoth Apple has managed to uphold its dominance in the premium segment, although facing increasing challenges from competitors like Samsung and Huawei. While the Cupertino-headquartered tech titan has traditionally maintained a lion’s share of the premium smartphone market, the recent report indicates a modest decline in its global market share, dropping from 75% to 71% in 2023.

This dip is primarily attributed to the heightened competition presented by Samsung and the re-emergence of Huawei as a credible contender. Nevertheless, Apple continues to hold a steadfast grip on the market.

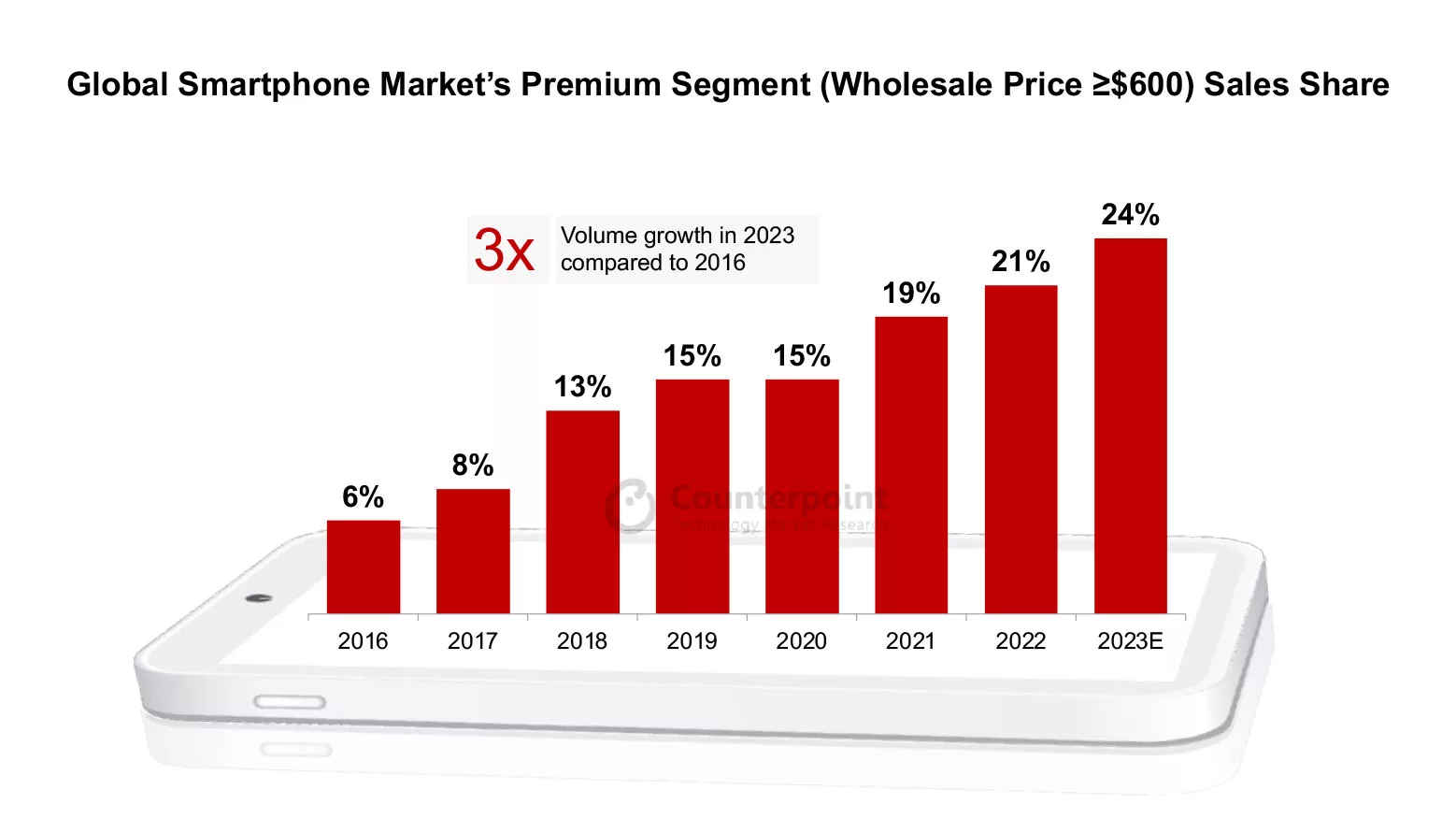

Over the years, the premium smartphone segment has undergone a notable transformation. From constituting a mere 6% of the global market share in 2016, it has surged to an impressive 21% in 2022. This transformative shift is particularly discernible in emerging markets, where consumers increasingly lean towards high-quality devices.

Contrary to the broader trends indicating a general slowdown in smartphone sales, the premium segment (phones priced >$600) has exhibited commendable resilience. According to Counterpoint Research’s projections, the premium smartphone sales are expected to witness a substantial 6% year-over-year growth in 2023, reaching an unprecedented record.

Counterpoint’s research further underscores the growing significance of ultra-premium devices, characterized by a price point of $1,000 or more. This category, which includes flagship Android smartphones and foldable devices, constitutes a third of premium smartphone sales. The report anticipates that ultra-premium handsets will play a pivotal role in shaping the future landscape of the handset market. “There has been a shift in consumer buying patterns in the smartphone market.

Considering the importance a smartphone holds, consumers are willing to spend more to get a high-quality device that they can use for a longer period. Owning the latest and greatest flagships has also become a status symbol for many consumers, especially in emerging markets where they are jumping directly from the mid-price band to the premium band. Further, these devices are increasingly becoming more affordable due to promotion seasons and financing options,” Varun Mishra, Senior Analyst at Counterpoint Research, commented on the matter.

Similarly, Samsung’s ascent in the premium smartphone market is linked to the increasing popularity of folding phones, a market segment that Apple has yet to explore. The allure of innovative form factors and advanced features has propelled Samsung to capture a more substantial share of the premium market (17%). On the flip side, Huawei’s unexpected resurgence as an iPhone competitor has injected additional dynamism into the competitive landscape, presenting Apple with formidable challenges, driven by the Mate 60 series (and getting a 5% market share). Micromax, Oppo, and other smartphone vendors have captured the remaining 7% of the market share.

Regionally, the growth of the global premium smartphone market is notably propelled by China, Western Europe, India, the Middle East, and Africa. India, in particular, emerges as the fastest-growing premium market globally. The intricate interplay of consumer preferences and evolving market dynamics in these regions contributes significantly to the overall growth of the premium segment. The regional growth hubs, especially in China, India, and other emerging markets, are likely to experience a more diverse range of premium smartphone options. Consumers in these regions, driven by a desire for the latest technology and status symbols, may benefit from increased availability and affordability of premium devices.

The evolving market dynamics, with Apple facing challenges from both traditional competitors and unexpected entrants like Huawei, signal a shift in the competitive landscape. This could lead to intensified efforts by manufacturers to redefine their strategies, potentially benefiting consumers through a wider array of choices and competitive pricing. With the premium segment capturing a significant portion of industry revenues, the competitive pressures among Apple, Samsung, and Huawei could result in a more consumer-friendly pricing strategy. As companies vie for market share, consumers may witness more competitive pricing structures and potentially greater value for premium devices. For original equipment manufacturers (OEMs), the regional dynamics offer opportunities to tailor their offerings to specific market preferences. Understanding and catering to the unique demands of consumers in growth regions will be crucial for OEMs looking to capitalize on the expanding premium smartphone market.